When it comes to data, insurance is all about assurance.

Insurance companies hold their clients' business, property, health, and financial stability in their hands, so trust and reliability are of utmost importance. An insurance organization’s credibility – and legal responsibility – rides on its ability to provide a clear, unambiguous policy snapshot, with the facts to back it up.

What’s behind that report?

- Deliver ironclad financial reports with which management can make business decisions.

- Collect, filter, and organize financial data, and deliver a result that encapsulates – and essentially hides – the complexity behind it.

- Determine that back office data’s lineage to confidently assert that it’s accurate: As data arrives, updates, and is replaced – all the while flowing through multiple systems – this complicated, dynamic stream of metadata is virtually impossible to track manually through a matrix of code and database definitions.

Before you make that change...

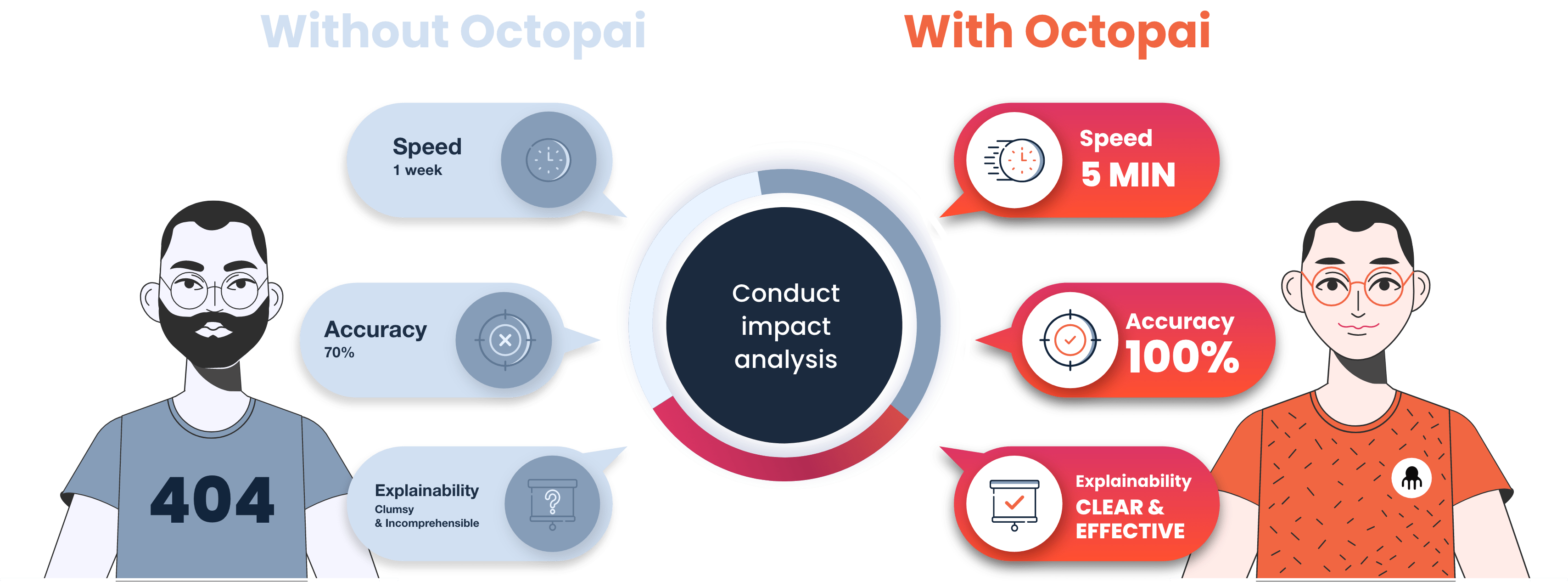

With each update to application code or database structure, you risk triggering an unintended “Butterfly Effect” of errors and miscalculations.

The implications go way beyond embarrassment and frustration; when specific regulations require strict adherence to data management, failure to conduct airtight impact analysis can be disastrous.

Until you can identify the source of your data, track its integration into other content, and understand what transformations followed, those changes should worry even the most confident data expert.

Our Solutions

Just like the octopus, which has an independent brain in each of its arms, our solution helps you keep tabs on all the “moving parts” of your data assets by analyzing metadata and cataloging it. Your one source of truth is company-wide, consistent, and always traceable.

Octopai lets you focus on your real goals – not time-consuming, manual exploration of your data environment – offering insights in three different ways:

Data Lineage

Data Catalog

Data Discovery

Cross-System Lineage

End-to-End Column Lineage

Inner-System Lineage

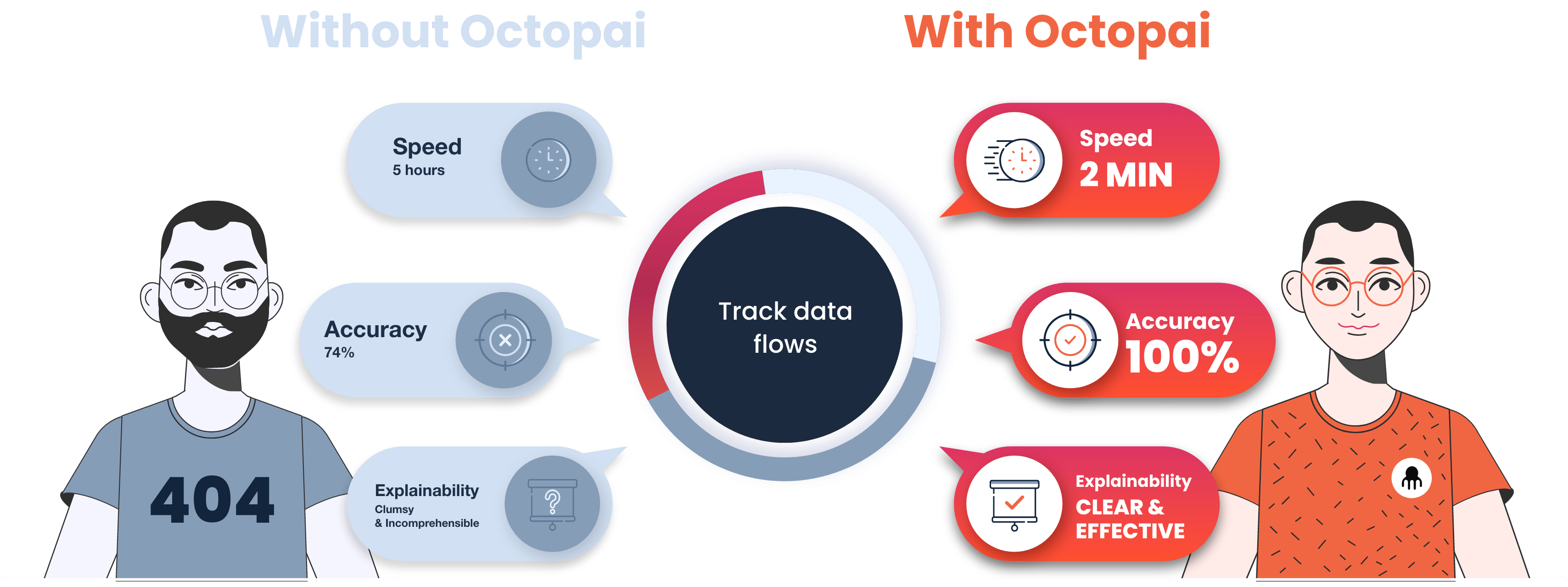

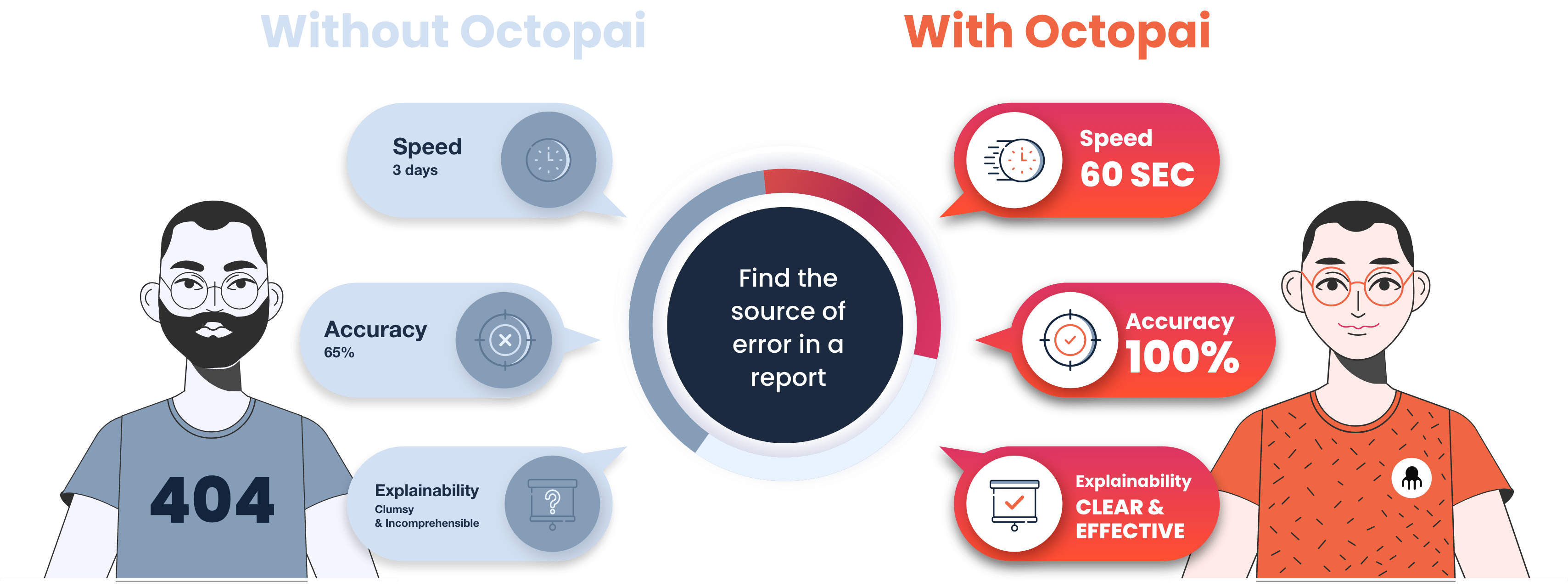

Speed

Manually tracing banking data lineage (even if that were possible to achieve) takes so long that the answers are often no longer current by the time they are presented.

Accuracy

With multiple interlaced data sources, databases, and applications, it’s critical to spot each reference and dependency, to avoid a single mistake that can trigger a waterfall of errors and confusion.

Explainability

Even the most quickly generated, elegantly compiled, data-rich report isn’t worth sharing if you cannot explain where the data came from and what calculations yielded your conclusions.

Success Stories

Request a Demo

The Octopai team is ready to welcome you with open arms … all eight of them!

Contact us today and we’ll show you how to attain the confidence you need from your data.