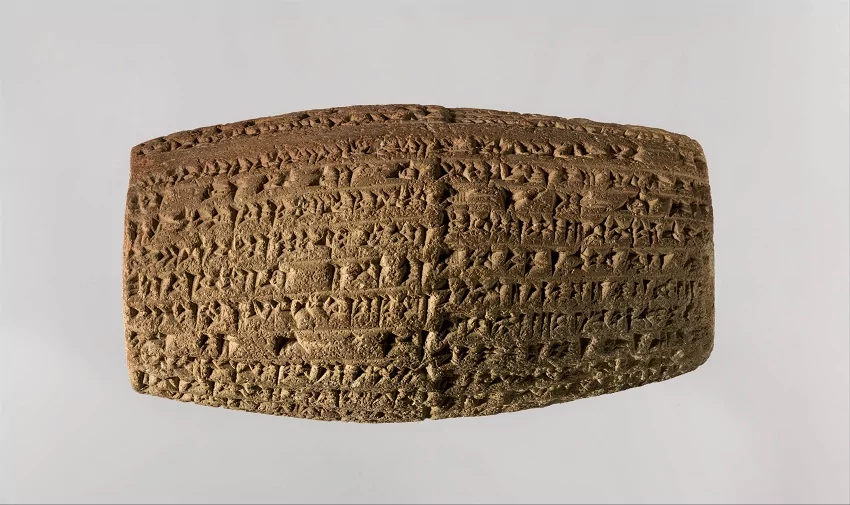

Regulatory standards for the insurance industry are almost as old as the insurance industry itself. They were set in stone (basalt or diorite, to be exact) by the Babylonian King Hammurabi around the year 1750 BCE.

Insurance in the ancient world tended to revolve around merchants shipping cargo. Insurance for your personal valuables, your pets or your fantasy football players was a thing of the future.

But the future has arrived, and the plethora of insurance options has brought with it a plethora of insurance data and the need for data regulation, protection, and modernization.

How can you keep up with the times, effectively use data in insurance and stay competitive for the future?

Data lineage will insure… err… ensure your ability to control and leverage your insurance data.

Let’s see how.

V, IV, III, II, I… Regulate!

The Code of Hammurabi didn’t require insurers to keep extensive records of their calculations and produce reports for external auditors.

Then again, their idea of “worldwide collapse” culminated in the flood myth of the Epic of Gilgamesh. The notion of a worldwide recession brought on by bad financial practices and dirty data in the banking and insurance industries wasn’t on the radar.

But once burned (or flooded, or whatever), twice shy.

The regulatory standards of Solvency II and IFRS 17 were direct reactions (along with Basel III, IV, and other numerically-designated innovations) to the pre-2008 financial dropping of the ball by insurers.

IFRS 17 (International Financial Reporting Standard 17)

IFRS 17 is an accounting standard that intends to make financial reporting on insurance contracts more transparent and consistent across the insurance industry.

In contrast to Hammurabi’s time, insurance contracts don’t stay in one place once they’re issued. They get evaluated, traded, assessed and commoditized. But in order to make sound decisions when it comes to investing in these insurance contract “products,” you need to be able to accurately evaluate and compare them to similar contracts.

This ability to compare is a big challenge when it comes to insurance contracts. For any given contract, you have to answer a plethora of questions, like:

- Is the valuation of the contract according to market value or present value based on cash flow?

- Which cash flows and liabilities are included?

- When do you value those cash flows?

- How does discounting factor into the cash flow value?

- How does risk change the valuation?

In short, when you see a number on a valuation: what does that number mean and where did it come from?

Data lineage is the process by which you discover “what a number means and where it comes from.”

Automated data lineage is when you don’t have to do it manually (which usually requires disproportionate investments of manhours, coffee and toothpicks to keep sagging eyelids open).

IFRS 17 mandates a universal standard of reporting for insurance contracts based on very granular, data-informed building blocks. IFRS insurance compliance will require you to calculate the contractual service margin (CSM) using all the risk-adjusted, discounted, future cash flows of the contract. This includes premiums, claims, acquisition costs, related expenses, and possibly investment components.

Calculating the CSM and showing the precise data you used to calculate it (and where that data came from, all the way back to its source) requires levels of transparency and accountability at a scale that can only be provided by automated data lineage.

Solvency II

Solvency II is a harmonized EU-wide legislative program of regulatory requirements for insurers. It covers responsible risk assessment and management, supervisory reporting, public disclosure and reserving adequate capital reserves.

After all, it’s all well and good to play with money that doesn’t physically exist, and use it to make more and more money… until someone actually wants to hold it as cash in his hand. Then you better have enough actual cash to produce.

How much capital do you need to have in reserve? That depends on your risk, as dictated by your organization’s current and past operational data. Solvency II demands higher standards of internal risk assessment and the data used to power that risk assessment.

How is your financial data team going to find the relevant data – and, on top of that, prove to external auditors that the data is relevant and accurate?

Data lineage to the rescue – again!

An automated data lineage tool gives you visibility into your data with clarity, granularity and precision. With it, your data team can:

- see exactly which source system the data came from

- see how numerous data silos were combined into a unified dataset, for instance, integrating risk (past) and finance department (future) data

- easily conduct impact analysis: if this data point or condition changes, what will be affected?

- know what data your reports are based on to help ensure that ALL your risk reporting is aligned and based on trustworthy data

- clearly demonstrate data flow and accuracy to regulatory authorities

- complete reporting and audit preparation quickly, smoothly and painlessly

The ease of execution alone could be a big capital savings. All the better for your solvency, my dear.

Up Close and Personal

Data privacy requirements aren’t unique to the insurance industry, but they play a larger role there than in many other industries.

After all, to make any financial sense, an insurance contract has to take into account all the relevant personal data of the insured: biographical, financial, health, employment, academic, property and more. When taking out a policy, you often have to tell the insurer information you wouldn’t tell your best friend – otherwise the policy could be rendered invalid.

All that personal, private information needs to be protected, whether under general personal data regulations like GDPR or CCPA, or under industry-specific regulations like the Gramm-Leach-Bliley Act (GLBA), the Sarbanes-Oxley Act (SOX) or the Health Information Portability and Accountability Act (HIPAA), the latter in the case of insurers dealing with health-related insurance.

A ubiquitous requirement of data protection regulations is the ability to pinpoint personal and private data in your data systems when asked to do so, whether to delete it (as a customer can ask you to do under GDPR), or to prove that it’s masked or anonymized (as required under HIPAA).

Without automated data lineage, this would-be simple identification process turns into a wild data chase. And even after it’s done, there’s always the concern you missed something. With insurance data lineage, following a data trail throughout your data landscape is a walk in the park.

The Ends Justify the Claims

Claims processing is a fact of insurance industry life. Sometimes the process is straightforward. Other times it can leave you scratching your head and asking, “What happened there?,” as what went into the claims process doesn’t appear to be directly related to what came out of the claims process.

The healthcare insurance industry is notorious for this kind of claims process “bait and switch.” (Our apologies; that makes it sound more devious than it is.) A medical claim submitted to an insurance company contains procedure codes. These codes are chosen by the medical providers to best represent the services provided. Often these codes are bundled into sets, with each set having its own code. As the claim goes through the adjudication process, sometimes the codes are changed by rules embedded in the claims adjudication system, or by manual intervention from a claim processor.

An analyst checking or using claim data that contains cases like these will see discrepancies stemming from the differences in the codes between submitted claims and adjudicated claims. The only way to get accurate data for analysis and avoid confusion or inaccurate conclusions is to use data lineage to see exactly what happened in that procedure code field throughout the history of the claim, from beginning to end.

Bringing Things Up to Speed

Data modernization in insurance companies has been an ongoing trend, both to simplify compliance with all the data regulatory standards mentioned above and to benefit from greater operational efficiency. McKinsey’s study on IT modernization in the insurance industry discovered that insurance service providers with a modernized IT core structure have an over 40% increase in policies per full-time employee, and an over 40% decrease in IT costs per policy. Good deal, all told.

Data modernization in insurance is a significant undertaking, often involving system or platform migration. Larger insurance carriers face the challenges of long-standing dependency on legacy systems (meaning much more to restructure and move) and usage of multiple platforms (which may create data siloing or redundancy, in addition to the need for operational resources to sync different data formats). Smaller insurance carriers, while dealing with less data and fewer data sources, also have a smaller budget for IT investment.

Regardless of carrier size and the different considerations that come with data modernization or migration, enterprise data lineage is a powerful tool for streamlining system migration, maximizing the benefits while minimizing the investment.

Data lineage can help immeasurably in:

- constructing a map of your current data environment and data flow (so you can redesign it to optimize the achievement of your business goals)

- seeing clearly which data assets and processes are valuable, which are discardable, and which need to be tweaked or fixed before a migration

- comparing old and new environments, or the new planned environment and the new actual environment, to make sure everything made it across and is set up the way you want

The insights delivered by an automated data lineage solution can accelerate a data migration, making it faster, simpler and less expensive (both during and after the migration). Now that’s something that can make both large and small insurance carriers happy.

Future-Proofing Your Insurance Company

The insurance industry as an industry has proven its staying power. As long as people have things that they value, and are concerned about losing the things they value, insurance will be around.

But no individual insurance company has that guarantee. In order to last in a competitive (and of late, disruptive) industry, you need to stay on top of your regulatory and modernization game.

Data lineage in insurance is here to help. Go make it your policy.